By Atlanta Mahanta

Africa Oil & Power(AOP) has released the Africa Energy Series Special Report (Gabon 2020) in line with Gabon’s objective of attributing more oil and natural gas explorers to investors and businesses seeking to broaden operations into the oil and gas field of Gabon. Gabon 2020 is an essential tool. The report of AOP which highlights Gabon’s oil and gas industry – provides a detailed overview of the investment prospects of Gabon in the sense of a continuing licensing round for most of the accessible offshore blocks in Gabon.

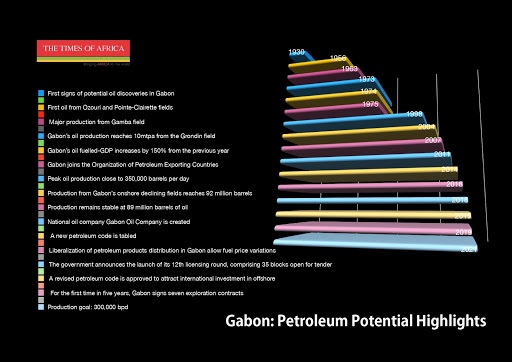

Gabon’s production peaks in 1997 were seen as a landmark producer in Africa with the first oil extracted in 1956. In Gabon’s history of oil production, 2020 marks a decisive year. In the 12th round of permits, a total of 35 blocks were offered and continuing, 12 exploration licenses were signed. The report explains the renewed attractiveness of the petroleum sector in Gabon including a new oil and gas code; the growing concentrate on natural gas production and the International Monetary Fund agreement to revitalize the economy of Gabon and thereby increase global trust in the growth of that country. “Gabon is committed to bringing new life to its high-potential oil and gas industry in spite of global challenges raised by the COVID-19. Gabon, with a long history of oil exploration and development and high hopes for the future, is strategically located in the Gulf of Guinea. In the coming months, we are going to be crucial in emerging from the global pandemic, but Gabon has good partners to count on, “said James Chester, Africa Oil & Power’s acting CEO.

In the Anglo-Saxon investment community Gabon is not well established but for a number of reasons Gabon is important in this Francophone central African region, which is beside the Equator and is likely to have an even greater economic impact over the coming years. The per capita GDP per capita was estimated in 2010 as ninth in Africa, at 6997 USD in PUP, sandwiched between above Algeria and Namibia below. PUP Parity was the first per capita GDP. In 2010, real GDP rebelled at an annual growth rate of 5.7%, up from 5.6% in 2007. The downturn was mainly due to the world financial crisis. The downturn

Like other African economies, Gabon is rich in resources and explains its recent economic growth and potential. It is estimated that in January 2011, Gabon had confirmed reserves of two billion barrels, almost six times the population per capita in Nigeria. Manganese mine is the world’s second-largest reserves. Recent finds of iron ore and total reserves of almost 1 billion tonnes, as well as gold, diamonds, lead, zinc, niobium and phosphates, have been observed. Gabon has proven to be a cornucopia of mineral wealth, and the government reports that more than 900 mineral mining sites have the potential.

Timber was the main source of exportation for the country before oil was discovered and a small population with over 22 million hectares of rainforest. Over 80 per cent of the country is forest-related and responsible and sustainable growth is now a core part of Gabon’s development strategy. Vast stretches of rainforest are protected, and the Government aims to encourage sustainable tourism for the wealthy. In 2020, 100,000 visitors are to be drawn to Gabon a year.

The Gabon Hydrocarbons General Directorate and the PGS have recently expanded the coverage of the Gabon MegaSurvey and significantly expanded the 3D seismic access over 35 blocks offered by the 12th Offshore Licensing Round. Gabon demonstrates once again its readiness to remain attractive in a highly competitive market environment and to engage regional and global investors to draw capital and technology into its sector.

The ongoing round of Gabon licenses has already been successfully launched in November 2018 and resulted in the signature of a record number of PSCs in sub-Saharan Africa last year. The Department of Oil, Gas, Hydrocarbons and Mines has extended the filing deadline by 30 April 2020 in response to current market conditions and the Covid-19 pandemic. The extended round offers an incentive for investors to start exploring what is one of the hottest upstream frontiers in Africa. The Chamber supports the inclusion of seismic and detailed knowledge as a key solution to support and extend the commitment of Gabon to prospective and reliable investors.

The Directorate-General for Hydrocarbons and PGS now provides more than 65,000 square meters as a further opportunity for investors. 3D seismic km and 2D seismic data in more than 21 000 km across 35 blocks, providing additional opportunity to incorporate new data into open block assessments. The MegaSurvey of Gabon, a cost-effective method to analyze and envision plays and migration routes, is open to investors. In line with the goal of attracting new oil and gas explorers, African Oils & Power, Gabon’s Africa Energy Series Special Report, has been launched by the AFP as a guide to investors and companies looking to grow their operations in Gabon’s oil and gas field. The 14-page report-which highlights Gabon’s oil and gas industry- provides a brief overview of Gabon’s investment in the context of the continuous licensing round for most of Gabon’s open offshore blocks and can be downloaded free of charge from the AOP Website.

Gabon’s first oil extracted in 1956 was produced in Africa at its peak in 1997. 2020 is a crucial year in the history of oil production. During the 12th round of licenses in the region, 12 exploration licenses have been signed and offered for a total of 35 blocks. The report explains Gabon’s current petroleum sector attractiveness and provides a new code for oil and gas. The agreement with the International Monetary Fund to revitalize Gabon, which increases international confidence in Gabon’s development, is underlined in the development of natural gas. Gabon’s commitment to a new life for its high potential oil and gas sector given the global challenges faced by the COVID-19. Gabon, strategically situated in the Gulf of Guinea, is on the right path with a long history of oil discovery, growth and high expectations for the future.

The investment world of Anglo-Saxon countries is not well-known in Gabon, but for several reasons, it will also have a much greater economic influence in the years to come from the central part of Africa, apart from the equator. Measured at the per capita level, in the sandwich above Algeria with Namibia below, it was 9th in 2010, with GDP measured per capita. In 2010 real GDP bounced again at an annual growth rate of 5.7% as compared to 5.6% in 2007. The downturn was mainly caused by the global financial crisis.

Gabon, like other African economies, is a resource-rich economy that represents its new economic development and potential. In January 2011, a total of almost two trillion barrels of confirmed Gabonese reserves, about 6 times as large per capita in Nigeria, were estimated. The second highest in the country is manganese mine worldwide. Moreover, recent tests have shown the presence of approximately 1 trillion tons of iron ore and complete reserve, and the inventory is maintained of gold, diamonds, plum, zinc, niobium and phosphates. Gabon has proven to be a cornucopia of the abundance of minerals, and 900 mining sites are reported by the government.

The nation was already vulnerable to timber, with a small population but over 22 million hectares in the rainforest, before oil and large export revenues were distorted. Over 80 per cent of the country with trees and a key feature of Gabon’s development plan now has a goal of responsible and sustainable development. Huge areas are protected as the government encourages nature reserves and eco-tourism. By 2020, 100 000 tourists are to be attracted annually to Gabon. Receiving an enlarged 35-block exposure to 3D seismic under this current 12th Round, Gabon’s Hydrocarbons and PGS General Directorate recently extended the scope of the Gabon MegaSurvey. Again, Gabon demonstrates its readiness to stay attractive and to include national and foreign investment in capital and technology in its industry in a competitive business setting.

Last year’s signing of a record number of PSCs in sub-Saharan Africa was a successful start of the ongoing Gabon Licensing Round. In response to emerging market conditions and the Covid-19 pandemic, the Ministry of Petroleum, Coal, Hydrocarbons and Mines extended this submission deadline after April 30 2020. The extended round provides an opportunity for investors to begin their exploration of one of Africa’s hottest upstream borders. The House supported supplementary seismic data as an important option for sustaining and increasing Gabon’s engagement with potential, credible investors. The Hydrocarbons and PGS directorate generally offer investors more than 65,000 square meters of land. Throughout 21 000 km of 3D seismic and 2D seismic data through 35 blocks, new data can be inserted into open block evaluations. Investors may use the Gabon MegaSurvey for review of regional activities, and for a cost-effective view of the game and migration pathway.

Investors who are prepared to view MegaSurvey items may use amme.info@pgs.com to learn more about custom-tailored seismic and well-data packs or to arrange data viewing.