Lagos and London, 24 April 2019: Leading digital money transfer company WorldRemit is considerably expanding its presence in Nigeria by joining forces with Paga, Nigeria’s first and leading mobile money company, for international digital money transfers.

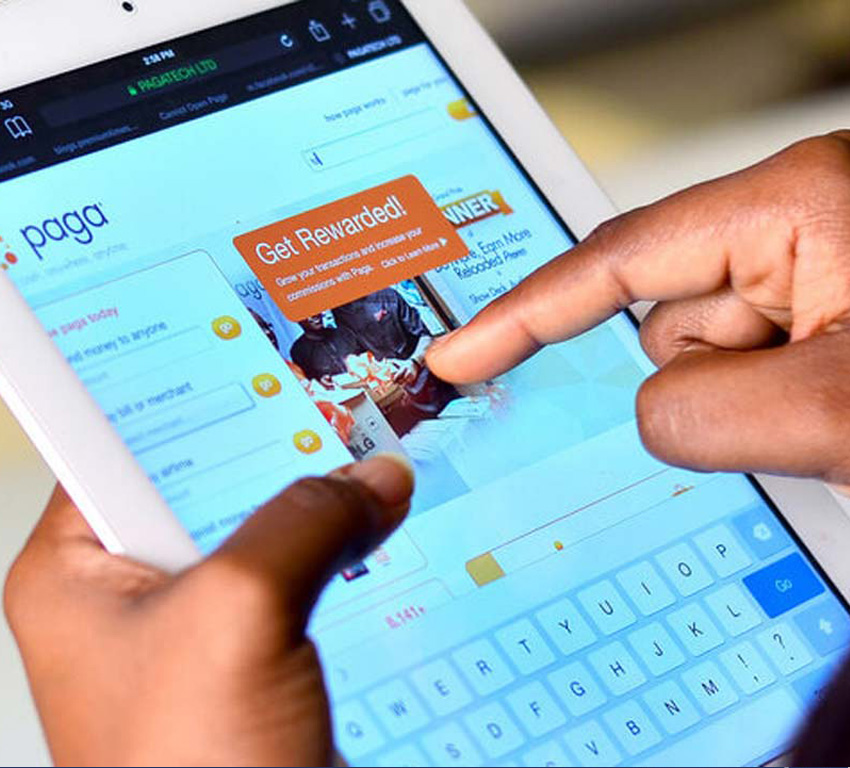

Using the WorldRemit app or website, the Nigerian diaspora living in over 50 countries will soon be able to send money quickly and securely to over 11 million Paga users.

The new partnership will considerably grow WorldRemit’s footprint in Nigeria, expanding the company’s service offering from bank transfer and airtime top-up to include mobile money. The introduction of international transfers to mobile-to-mobile accounts in Nigeria supports WorldRemit’s commitment to financial inclusion in the country, where nearly 40% of the adults are unbanked.

WorldRemit’s mobile-first, digital model saves customers time and money as they do not have to visit a bricks and mortar agent to send money home. International transfers to Paga mobile money wallets via WorldRemit will be instant. Recipients will then be able to transfer funds from their Paga wallets to other users of Paga wallets or bank accounts, top-up mobile airtime, and pay for bills and groceries at shops and businesses that accept Paga payments. Customers will also be able to withdraw money as cash at Paga agent locations, perform cardless withdrawals at select ATMs or store their funds in their Paga accounts.

Since its launch in 2009, Paga has been recognized by the World Bank and International Monetary Fund as the fastest-growing Agent Network for its role in driving financial inclusion in Nigeria. Paga is the country’s widest reaching mobile money company, with over 14,000 agents across nearly 36 states, and is committed to making it easy for people to send and receive money digitally. Last year, after a $10 million raise, Paga announced plans to expand into new global territories and introduce new partnerships and products to the market.

With a diaspora of 15 million people living in countries including the United States, the United Kingdom, Australia and Canada, remittances play a significant role in Nigeria’s economy. The World Bank estimates that in 2018 alone Nigeria received $26 billion in remittances, making it the largest recipient in Africa.

Tamer El-Emary, Chief Commercial Officer at WorldRemit, comments: “Paga and WorldRemit share a commitment to making life easier for Nigerians sending and receiving money. Our partnership represents a new milestone for WorldRemit as we expand our service offering in Nigeria to include mobile money, a technology that has been transformational for communities across Africa.

With WorldRemit, customers living in over 50 countries can send money home 24/7 with a few taps from their phones. Our partnership with Paga supports financial inclusion initiatives in Nigeria by introducing a new and convenient way for people to receive money from abroad and directly into their mobile money accounts.”

Tayo Oviosu, Founder & CEO of Paga, said: “At Paga, we are committed to making money transfers seamless and convenient. Our partnership with WorldRemit is a further example of our commitment to making it easy to send and receive money digitally. Many Nigerians in the diaspora support members of their family living in Nigeria, and often times these family members may be depending on that stipend to survive.

Using WorldRemit’s website, Nigerians in the diaspora can send money home to family and friends using the mobile phone number of the recipient. The money will be instantly credited to a Paga wallet for the recipient and available for immediate use on Paga. This is just one of the many ways we are making life possible for Nigerians at home and abroad.”

Visit the WorldRemit website for more information on how to send money to Nigeria.

WorldRemit customers complete over 1.3 million transfers every month from over 50 countries to over 145 destinations.