Although the global COVID19 pandemic has overwhelmed governments and citizens worldwide, many of the challenges they faced at the beginning of 2020 still exist. According to NOAA’s National Centers for Environmental Information, the first three months of 2020 were the second-hottest record since 1880. In Africa, the cost of climate adaptation is forecast to reach up to $50 billion a year by 2050 in case of another problem is raising by 2°C global warming (3.6 ° F). Climate change risks can be at least as large as those posed by Covid-19, note analysts at Brookings Institution.

The expectation is to help make solar and wind power more competitive on the open market, as the input costs for renewable energies drop rapidly. This can be achieved by a policymaker “by clear environmental standards and a long-term plan for the reduction of fossil-fuel subsidies to create realistic expectations for long-term income,” Brookings says. In addition, this will allow investors to accept green investment’s fixed costs.

According to a survey by AVCA, the African private equity trade body, investors from Africa already are serious about this, both in terms of assessing risk by way of a climate lens, as well as of investable opportunities. Africa is sometimes referred to as the most vulnerable continent to the rapidly evolving consequences of global climate change. In areas like Cape Town, the wetlands and flooding in many of Africa ‘s towns, we are already experiencing major problems.

By making investments “sometimes” and “on a regular basis” up to 77 per cent of all African and Non-African investors consider climate risk. The vast majority of investors (95%) were concerned about the risks that their investor companies face as opposed to 90% who are concerned about their carbon footprint and just over half regard risk mitigation as an investment opportunity.

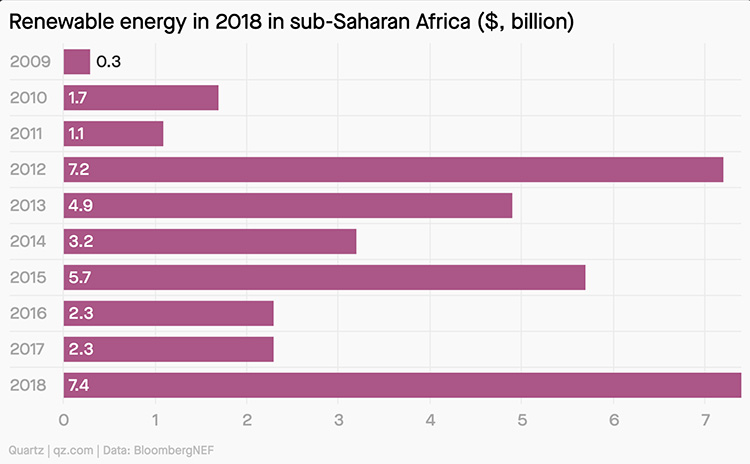

Among the majority of African climate-lens investors, up to 95% are investing best in energy, as well as agriculture (62%) and water (44%). “We are moving from a sensitization process to a measurement phase which will provide businesses with the knowledge they need to make informed decisions on climatic risk and opportunities,” says AVCA. Private and public investments in renewable energy have grown in the last decade, driven by the solar and wind sectors in the Continent. According to BloombergNEF, it jumped in sub-Saharan Africa to 7.4 billion dollars in 2018 from 2.3 billion dollars in 2017. A major onshore wind project has produced $4 billion for 2018 in South Africa ‘s investment.

Inputs from qz