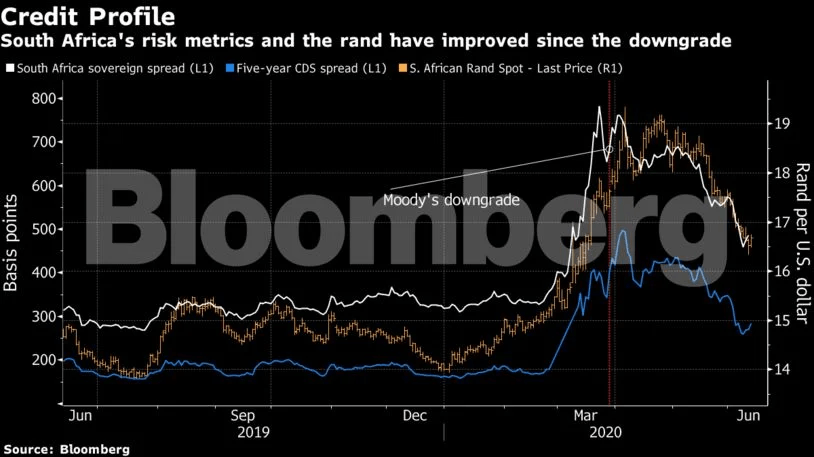

The country is paying less to borrow in a local currency now than ever before the last investment-level ranking of Moody’s Investors Service was withdrawn on 27 March. The rand has rebounded, risk rates return to their pre-decline rate, and in the first five months of the year, foreign investors are returning to the country’s bond market.

This demonstrates how global developments – the emerging-market rally driven by global monetary and fiscal stimulus and weak dollar in particular – are more important than national risks. This is good news too for President Cyril Ramaphosa, who had to borrow more as the economic downturn, exacerbated by the lock-down of COVID19, slashed tax revenue.

The loss of the last investments and subsequent expulsion from the FTSE World Government Bond Index in South Africa has led to a decrease of the rand ‘s idiosyncratic risks and the currency is, another “bellwether for global recovery,” according to Societe Generale SA.

Societa General strategists led by Jason Daw wrote in a report “Although the fiscal position of South Africa is becoming more and more dangerous, fiscal dynamics are less likely to be the driving force than post-pandemic global recovery.”

- The rand weakened more than 9% in the days following the Moody’s downgrade to a record R19.35 per dollar on 6 April but has rebounded 13% since then

- The cost of insuring South Africa’s debt against default for five years using credit-default swaps more than doubled in March and April to a record, but fell back to a three-month low this week

- The extra premium investors demand to hold the country’s dollar bonds rather than US Treasuries has narrowed 296 basis points from a record high in March

- After selling a record R64 billion ($3.8 billion) of South African government bonds on a net basis in the five months through May, foreign investors are buyers again. Inflows this month through June 10 stood at R6.9 billion, according to JSE Ltd. data

- The National Treasury has attracted orders for more than twice the amount on offer at its weekly debt auctions, even after increasing sales by 34% last month

data source:businesstech

According to Societe Generale, bond returns can be reduced as inflation slows due to low oil prices and a pandemic decrease in consumer demand. The strategists said that the central bank ‘s acquisition of bond and the world’s quest for yield would also help South African debt.